Get to know better the Social Security Fund and its Schemes in Nepal

Here, I want to make a clearer illustration of how the Social Security Fund operates across four different facilities as set forth by the latest Guideline together with some newer features.

I will use an example:

Example:

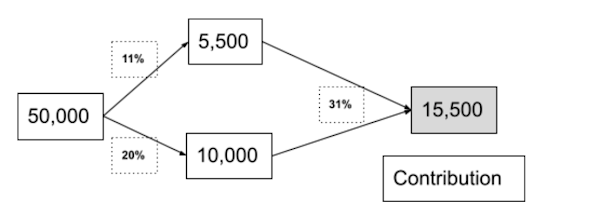

Let us take NPR 50,000 as the basic salary of an employee whose employer organization has signed up for the Social Security Fund.

Hence, out of your basic salary of NPR 50,000, your employer deducts 11% from it as the first share, deducts another 20% from the basic salary and deposits at total of 31% of your basic salary to the Fund on a monthly basis.

The amount of NPR 15,500 is then distributed among 4 different schemes as:

1. Medical and Safe Maternity Scheme

2. Accidental and Disability Protection Scheme

3. Dependant Protection Scheme

4. Old Age Security Scheme

The distribution is made in a proportion as follows:

Major Benefits of each Schemes A. Medical and Safe Maternity Scheme

a. To be able to claim facility under this scheme, the contribution period must have exceeded consecutive 3 months or up to three months after the contributor has stopped contributing the fund.

b. Safe Maternity Scheme applicable for both contributor and/or her/his spouse.

c. Up to 1 lakh (annual) directly paid to the hospital if the contributor is hospitalized.

d. Up to 25,000 (annual) reimbursement if the contributor did not get hospitalized.

e. 20% of the total treatment cost to be borne by the contributor her/himself.

f. 1 month of basic salary paid per birth per child. Applicable for both abortion and/or still birth.

g. 60% of the basic salary paid if treatment undergoes in the hospital or home based treatment is prescribed which exceeds 12 days.

h. 60% of the basic salary paid if extra maternity leave other than minimum 2 months of leave is required and the number of days should not exceed 98 days in total i.e. upto 38 additional days.

B. Accidental and Disability Protection Scheme

a. Two type of facilities as follows:

Facility for Accidental and Facility for Disability.

b. General Accident and work-related accident distinguished.

c. Work-related accidents are completely reimbursed (active after 2 years of contribution start date until 2 years after the contribution is discontinued).

d. Treatment must take in the hospital where the Social Security Fund has entered into an agreement, otherwise up to 7 lakhs only is borne.

e. General accidents are borne up to 7 lakhs.

f. In case of permanent disability for a certain period of time- 60% of the basic monthly salary until recovery.

g. In case of permanent disability - 60% of the basic monthly salary throughout life

h. Disability reassessed at the age of 58 of the contributor

C. Dependant Protection Scheme

a. Spouse, son, daughter-in-law, daughter, father, mother, mother-in-law, father-in-law, grandson or granddaughter as dependents.

b. Facilities as follows:

i. Pension for spouse (60% of final basic salary throughout life on a monthly basis)

ii. Educational grant for offsprings (40% of final basic salary until age 18 or until age 21 if the education is continued, evenly distributed if more than 1 offsprings, discontinues after the offsprings are married or completed education before age 21, facility continues if the offsprings has/have physical or mental disability)

iii. Facilities for dependent parents (for dependent parents with no spouse nor offsprings, 60% of final basic salary throughout life on a monthly basis, evenly distributed across father and mother, does not apply if the parents are employed)

iv. Funeral grants (one time 25000)

D. Old Age Security Scheme

This the 28.33% of contribution. Here, we’ll again refer to the basic salary of NPR 50,000.

NPR 14165 is a combination of the following:

a. Pension Scheme

b. Retirement Service Scheme

The proportion of NPR 14,165 is as follows:

Hence, the facilities are entirely dependent on this distribution of contribution against among two schemes:

a.Pension Scheme

Pension activates after the contributor completes the age 60 or at least 180 months of contribution.

- Monthly pension after a calculation is done where total contribution amount (for 180 months of service) and the profit (prescribed) is divided by 160.

Example with NPR 50,000 basic salary or NPR 10,000/month of contribution:

NPR 10,000*180 months = 1,800,000 + profit

Monthly Pension = 11,250 + Profit

- If the contributor dies before the maturity of the contribution, entire contribution plus profit (prescribed) is paid to the dependent.

- If 180 months of contribution is completed but the contributor but completes age 60, contributors would have options to either withdraw all the money plus profit or continue receiving a monthly pension where the total contribution amount is divisible by 160.

b. Retirement Service Scheme

This scheme can be made comprehensive upon the choice of the contributor where s/he can transfer her/his existing contribution in other platforms into the Social Security Fund or chooses to voluntarily deposit additional amount in fund out of her/his monthly salary.

Contributors can withdraw all the money after retirement or termination of employment.

Example with NPR 4,165 monthly contribution/month of contribution:

Total Deposit for 180 months = 749,700

Total withdrawal = 749,700 + interest

a. Dependents of the contributor can withdraw all the money if the contributor dies.

b. 80% of the total deposit in this scheme can be borrowed as Special Borrowing after the contribution is done consecutively for at least 3 years.

Comments

Post a Comment